TL;DR

|

Not all hotel stays are the same, and anyone managing a property knows that guests staying for a night are nothing like those staying for a month. While short-term visitors look for quick convenience, long-term guests crave comfort, consistency, and a sense of belonging.

Extended stay properties have become a cornerstone of modern hospitality. Whether it’s corporate travelers on month-long assignments, remote workers seeking stability, or families relocating for long-term projects, the demand for longer bookings is steadily increasing. In fact, a recent report from The Highland Group in the U.S. suggests that extended-stay properties recorded room revenue growth of about 1.9% in July 2025, while the overall hotel industry saw a revenue decline of 0.3%.

However, many hoteliers are still relying on traditional daily-rate pricing models that don’t capture the full revenue potential of these guests. A long-stay pricing strategy offers a dynamic approach to maximize revenue while keeping guests satisfied. By using smart forecasting, predictive analytics, and AI-driven optimization, hotels can turn extended stays into a highly profitable segment.

This guide explores practical methods to price long-term bookings intelligently, boost extended stay hotel revenue, and ensure every guest contributes optimally to your bottom line.

Growth of Extended Stay Models

The extended stay model is no longer niche and has become one of the most profitable hotel models worldwide. Before understanding how and why it became mainstream, let’s go back in time and see where the idea began.

The evolution of extended stay models

The concept of extended stay hotels started when Jack DeBoer founded Residence Inn in 1975, introducing travelers to a unique all-suite format that combined comfort and convenience. Marriott later acquired the chain in 1987, and DeBoer continued his vision by launching Summerfield Hotel Corporation in 1988, which Hyatt eventually purchased. Competitors soon followed the trend, with Homewood Suites launching in 1989 and Extended Stay America entering the market in 1995, becoming one of the largest long-stay hotel operators in the United States.

Through the late 1990s and early 2000s, the supply of extended stay hotels grew rapidly, offering travelers more flexibility and space. The model gained another wave of popularity after the 2008 crisis when guests started prioritizing value and stability. Then, after the pandemic, the segment surged again as travelers and remote workers sought longer-term accommodations that felt more like home.

Today, the global extended stay hotel market stands at around $54.5 billion and set to reach $166.5 billion by 2032. This increase highlights the growing confidence among investors and property managers in sustainable revenue from longer stays.

Factors affecting the growth of the extended stay models

Several factors are now driving this shift in hospitality demand. Here are some of the most popular ones:

- Remote work trends: The shift to remote work has changed how people travel and stay, with professionals seeking comfortable, longer-term stays across different cities and countries. The rise of “bleisure” travel, “workations,” and digital nomad lifestyles reflects how mobility has become a normal part of modern work culture.

- Project-based relocations: Industries like construction, manufacturing, and energy often relocate workers for projects that last several months or even years. In 2024 alone, 244,000 jobs were announced in the United States through reshoring and foreign direct investment, which raised demand for extended accommodation options.

- Corporate travel demand: Guests on long-term assignments often choose apartment-style hotels that offer comfort and flexibility during their transition. These bookings generate higher overall spending per stay and reduce turnover costs. When hotels combine AI long-stay optimization with a carefully designed long-stay pricing strategy, they turn these longer visits into dependable and sustainable sources of profit.

With higher average spend per booking and lower turnover costs, extended stay guests offer more predictable revenue streams than typical transient guests. However, capturing this revenue requires more than applying traditional daily rates.

Why Traditional Pricing Fails for Long-Term Guests

Many hotels rely on flat discounts for long-term guests, typically 5-10% off the standard nightly rate. While simple, this approach often leaves money on the table.

Traditional pricing models fail for several reasons:

1. Ignoring length-of-stay profitability

When a guest stays four weeks or more, treating that stay the same as a one-night booking misses the opportunity to increase total revenue. A tiered discount structure can bring in more dollars across the entire stay while meeting guest expectations.

Studies increasingly show that hotels using tailored length of stay pricing capture higher revenue per booking and better occupancy stability.

2. Static pricing disregards demand

Flat discounts ignore fluctuations in demand and occupancy, and they fail to respond when demand rises unexpectedly. When hotels apply traditional pricing, they miss chances to increase rates during high-demand periods or optimise length-of-stay offers when demand drops.

According to a 2025 pricing trends study, many hotels adopt dynamic pricing tools to adjust rates in real time based on demand. And when they do, they see a 40% reduction in pricing tasks.

3. Reduced flexibility

Without dynamic or stay-based pricing, hotels cannot adjust rates when bookings are extended, cancellations occur, or last-minute changes arise. That means the hotel might offer too much of a discount, even when demand spikes, or leave money on the table when a guest prolongs their stay.

Sticking with traditional pricing limits your responsiveness and potential for margin.

4. Over-discounting culture

When hotels rely on standard flat discounts for long-term guests, they train buyers to expect deep cuts and ignore overall revenue potential.

This downward discount culture goes against the principle of increasing average revenue per stay and threatens profitability margins when occupancy is high and variable costs rise.

5. Mismatched guest segmentation

A single discount fails to separate guests who value stay length from those who search for the lowest cost. When hotels ignore guest segmentation, they apply traditional pricing across diverse segments and lose the chance to capture higher-value stays that would pay more.

Good practice differentiates between guests staying a week and guests staying a month.

To prevent this, AI-powered revenue management software such as ampliphi RMS recognises booking patterns, guest behaviours, and pricing outcomes to refine your revenue approach over time.

How AI Automates Long-Stay Rules

Managing pricing for extended stays sounds easy at first glance, but it rarely is. Guests who book for two weeks or more often expect better rates, yet hotels struggle to find the right balance between discounts and profitability.

With ampliphi RMS and its AI optimization engine, hotels can automate long-stay rules that learn, adapt, and refine pricing strategies over time:

1. Dynamic pricing that adjusts to demand patterns

Every long-term booking carries a different revenue potential. Some guests stay during off-peak periods, while others fill valuable high-demand weeks.

ampliphi RMS automatically reads these trends and adjusts prices in real time. Instead of sticking to static discounts, it evaluates occupancy forecasts, booking pace, and market demand to keep rates profitable and competitive.

In fact, hotels using AI-driven pricing saw up to a 35% increase in RevPAR due to automated demand forecasting and pricing adjustments. That kind of agility lets you capture more bookings without sacrificing margins.

2. Automated rules that evolve with every booking

Long-stay pricing works best when rules adapt as the system learns. ampliphi RMS uses AI optimization to detect guest behavior patterns, booking windows, and stay length trends that influence profitability.

The system improves every week it runs, evolving from basic pattern recognition to advanced data analytics and predictive insights. It learns what rates work best for your property and automatically applies those insights across all booking channels.

Over time, this creates smarter rate adjustments that respond to real-world conditions without manual effort.

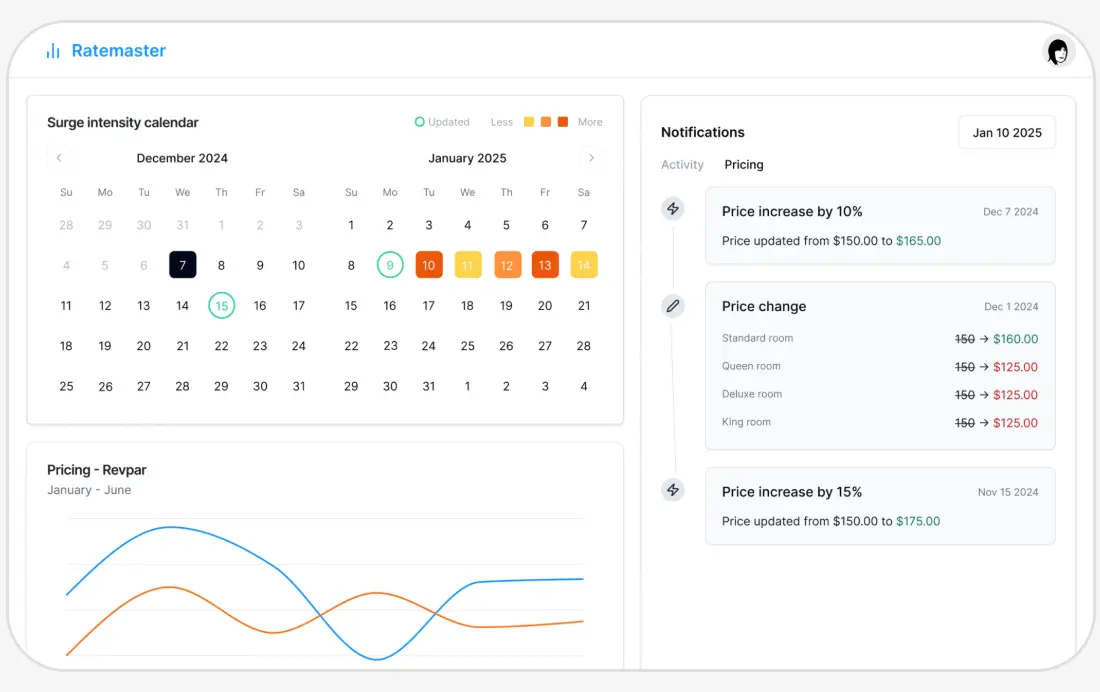

3. Integrated revenue calendars for full control

Most hoteliers still manage long-stay discounts manually across multiple spreadsheets or disconnected systems. ampliphi RMS replaces that with a centralized rate calendar that syncs updates instantly. You can review, approve, or edit rates without switching platforms, giving you total visibility into long-stay pricing performance.

The AI engine also identifies anomalies such as over-discounting or pricing overlaps and recommends corrections before revenue leaks occur. This means less manual oversight and more confidence in every decision your system makes.

4. Predictive AI that plans months ahead

Anticipating seasonal trends and lead-time effects is where many traditional pricing models fail. ampliphi RMS uses predictive analytics to read both historical and forward-looking demand data, refining its forecasts daily.

If your property sees a spike in long-stay demand during corporate events or holidays, the system automatically recalibrates rates to reflect it. This foresight helps prevent underpricing extended stays while keeping your offers appealing to long-term guests.

5. Automation for long-term profitability

AI automation does not mean losing control. ampliphi RMS gives you full authority to override, adjust, or fine-tune any recommendation whenever you choose. The software acts like a smart assistant that works behind the scenes, applying protective measures to avoid rate dilution or revenue loss during extended-stay periods.

It maintains rate integrity, prevents overlapping offers, and preserves your long-term profitability while optimizing for short-term gains. This balance between automation and human control helps maintain steady RevPAR growth across all segments.

📌Also read: How To Calculate The ROI Of Switching To AI Revenue Management Software

Forecasting Occupancy and Demand for Extended Stays

Accurate forecasting helps hotels capture revenue from long-term stays, while maintaining consistent occupancy across all seasons. Extended stays behave differently from standard nightly bookings, so hotels need to consider multiple factors to plan effectively:

- Historical booking patterns: Tracking previous arrivals, length of stay, and seasonal peaks helps predict when long-term guests are most likely to book and how long they will stay. Hotels using ampliphi RMS can analyze these patterns to identify high-demand periods and adjust rates proactively to protect revenue and maintain stable occupancy.

- Market segmentation: Segmenting guests into categories such as corporate travelers, relocation assignments, and leisure travelers allows hotels to forecast demand for extended stays more accurately. Each segment behaves differently regarding booking windows, length of stay, and spending, so a thoughtful long-stay pricing strategy ensures profitability and prevents lost revenue opportunities.

- Cancellation and early departure probabilities: Extended-stay bookings carry a higher risk of schedule changes, early departures, or cancellations, which can hurt revenue if not managed correctly. Hotels using real-time price optimization for long stays can calculate probabilities for these events and adjust pricing or overbooking strategies to protect margins while keeping guests satisfied.

- Key performance indicators: You should also track these KPIs to refine the long-stay pricing strategy of hotels continuously:

- Average length of stay (ALOS): Measures typical booking duration and helps plan occupancy.

- Revenue per extended stay (RPES): Focuses on the profitability of long-term guests rather than per-night revenue.

- Occupancy rate: Particularly for rooms targeted at extended stays, tracking demand vs. availability informs pricing adjustments.

Using predictive analytics, hotels can identify low-demand periods and incentivize longer bookings with tailored promotions, or conversely, maximize revenue during high-demand windows with minimal discounts.

Case Example: Maximizing Profitability per Guest

Your city hotel starts noticing slower midweek bookings, especially during Tuesday and Wednesday nights. In a manual system, this drop might stay unnoticed until the numbers start hurting your bottom line. ampliphi RMS quickly detects these small shifts in occupancy patterns and adjusts rates across every connected channel, keeping your extended stay hotels competitive before demand drops further.

Let’s say, 150-room city hotel observes midweek occupancy dropping from 80% on weekdays to 60%.

Traditional pricing:

- $150 per night for all days.

- Midweek revenue per room: 60% × $150 × 2 nights = $180 per room on average.

With ampliphi RMS:

The AI adjusts rates dynamically based on demand:

- Tuesday: $160 (slight increase to capture business travelers)

- Wednesday: $140 (slight discount to encourage bookings)

- Thursday: $150 (standard rate)

Result:

- Average midweek revenue per room: (60% × $160) + (65% × $140) ≈ $186

- This represents a 3.3% increase in revenue per room

In fact, the longer your property runs ampliphi RMS, the smarter the system becomes. Powered by AI and predictive analytics, it continuously learns from your past bookings and market behavior, which reduces pricing errors, improves accuracy, and increases revenue confidence with every update.

- Week 1 to 3: The system begins recognizing basic booking and occupancy patterns, leading to early improvements in pricing.

- Week 4 to 6: ampliphi RMS refines its rate strategies and sharpens accuracy across all booking channels.

- Week 7 and beyond: Predictive capabilities strengthen as the system delivers deeper insights and forecasts, helping your property stay proactive instead of reactive.

With this consistent learning cycle, your hotel captures more revenue per available room, keeps rates competitive, and gives your team time to focus on guest satisfaction rather than rate management.

📌Related read: How To Choose The Right AI Revenue Management Software For Your Hotel

Now’s the Time to Amplify Your RevPAR

When you stop treating extended stays with the same flat discount as short visits and instead use AI-powered pricing rules, you unlock value that gets missed with traditional tactics. Hotels that adopted AI optimization platforms reported revenue gains of up to 35% in recent implementations.

With ampliphi RMS, you capture those gains by adapting rates to guest bookings, stay length, and demand shifts. Your team can spend less time manually updating spreadsheets and more time focusing on guest experience. Embracing the right tools for extended stay hotels converts a complex problem into an opportunity that grows over time.

Want to see how ampliphi RMS can transform your pricing strategy and boost hotel revenue from every booking? Book a personalized demo today and watch smarter pricing in action.

FAQs

What is long-stay pricing?

Long-stay pricing refers to dynamic rate strategies designed for guests staying multiple nights or weeks. It balances profitability and occupancy by offering flexible, data-driven rates that attract longer bookings without undervaluing your inventory during high-demand periods.

How does AI help manage extended stays?

AI simplifies extended-stay management by forecasting demand, predicting length-of-stay patterns, and adjusting prices automatically. ampliphi RMS continuously learns from your property’s performance and market data to optimize rates, maximize profitability, and protect long-term revenue opportunities in real time.

What KPIs matter for long-term bookings?

The key performance indicators (KPIs) for long-term bookings include RevPAR, occupancy rate, the average length of stay (ALOS), and average daily rate (ADR). Monitoring these metrics helps hoteliers understand demand trends, identify revenue gaps, and make smarter, data-backed pricing decisions for sustained profitability.